Interest rates are going down, but how low can they go?

Posted

Photo:

Things could get rough on global markets if the Fed does not deliver more rate cuts. (Reuters: Simon Dawson)

Just how low can they go? It is the big question on interest rates being asked of central banks mired in a world of low inflation and less than robust growth.

Key points:

- Markets expect more rate cuts from US Federal Reserve, perhaps starting this week

- Growing number of economists expect RBA will cut to 0.5pc

- Oil market delicately balanced between falling demand and supply concerns over renewed US/Iran tensions

The US Federal Reserve’s Open Market Committee (FOMC) meets this week and may knock rates down another peg.

The betting is 50/50, but at the very least the FOMC will have to maintain a strong bias to more cuts in its post-meeting commentary.

The Bank of England also has a chance to cut although it probably won’t and the Bank of Japan, with its official rate already pegged below zero, has nowhere to go and will probably be on hold again.

But it is the Fed’s decision that really matters.

Pivotal week

To an extent the Fed, and its chair Jerome Powell, are in a jam, having raised expectations of a cut despite the economy remaining in relatively good shape.

Despite GDP growth in the US nudging above 3 per cent, almost-record unemployment and reasonable wage growth, markets, and significantly the White House, are clamouring for another cut.

Only last week, President Trump reached into his bountiful bag of insults to inform the world the Fed didn’t have a clue about setting interest rates.

In some economies it might be deeply concerning to have the boss denouncing a central bank as clueless. In the US, it’s a signal to buy.

US markets have rallied around 5 per cent this month largely on the back of softer economic data and Mr Powell’s comments the Fed would respond “as appropriate” to the risks from a global trade war and other developments.

Wall Street paused from its recent buying spree on Friday to assess the chances of nothing happening this week and finished the session marginally lower.

Futures trading on the ASX points to a flat opening on Monday. It is fair to say this week is shaping up as pivotal in the near-term fortunes for global markets.

Markets on Friday’s close:

- ASX SPI 200 futures +0.1pc at 6,565, ASX 200 (Friday’s close) +0.2pc at 6,554

- AUD: 68.7 US cents, 61.3 euro cents, 54.6 British pence, 74.6 Japanese yen, $NZ1.06

- US: Dow Jones -0.1pc at 26,090 S&P500 -0.2pc at 2,887 NASDAQ -0.5pc at 7,798

- Europe: FTSE -0.3pc at 7,346 DAX -0.6pc at 12,096 EuroStoxx50 -0.3pc at 3,379

- Commodities: Brent oil +1.1pc at $US62.01/barrel, Gold flat at $US1,341/ounce, Iron ore $US111.00/tonne

Given Wall Street’s lofty valuations, you can bet it is primed for a fairly sharp retreat if a rate cut is not delivered on Wednesday.

“The market has somehow convinced themselves that we are in an easing cycle. I am not sure how we got so far ahead of ourselves,” National Securities market strategist Art Hogan said.

“So now you’ve got Powell … kind of painted into a corner that he is really going to have to navigate carefully because you have market expectations that he said he would do whatever is appropriate.”

The market expectation is around three cuts in the US by the end of the year.

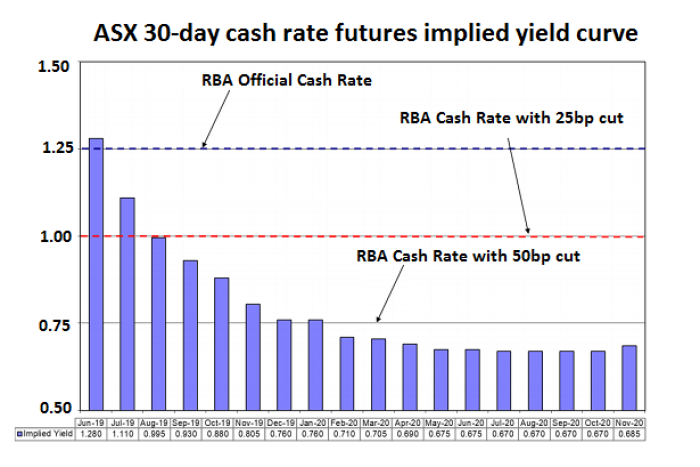

In Australia, two cuts are fully priced in.

However, those two cuts may be conservative as an increasing number of economists are arguing for a cash rate of 0.5 per cent or lower.

Unemployment needs to fall to 4.5pc

RBC’s Su-Lin Ong added another cut to her expectations following a speech in which RBA assistant governor Luci Ellis argued unemployment needed to fall a lot more if the economy and wages were to pick up.

The RBA now appears to be thinking an unemployment rate of 4.5 per cent of lower would get things back on track.

And it not just the unemployment rate that is remaining stubbornly high. There is still a large degree of slackness in the labour market with underemployment — those in work, but looking for more — stuck near historical highs.

While Ms Ong is not a cheer leader for rates cuts, she is now forecasting the cash rate will be 0.5 per cent by the end of next year.

“It is often forgotten that the RBA has a dual mandate — a full employment target as well as an inflation target — in the pursuit of economic prosperity,” Ms Ong noted.

“Ellis has, effectively, suggested that full employment is far lower than previously thought. In practice, this means that monetary policy needs to be recalibrated.”

Ms Ong said if you add in the expected cooling of developed economies next year, then the RBA cutting its cash rate below 1 per cent is largely sealed.

“We remain mindful that policy traction from further RBA cuts to an ever-lower cash rate is likely to be less effective, especially given the elevated level of household indebtedness,” she warned.

Ms Ong said as the RBA hits the lower limits of interest rate cuts, the greater is the need for policy responses from government.

“As we head closer to the lower bound, we hope that the emerging discussion around more active counter-cyclical fiscal policy steps up; additional productive infrastructure investment, additional expenditure on skills and resourcing, the bringing forward of income tax cuts, acceleration in the reduction of small/medium company tax cuts.”

The idea that unemployment needs to be sharply lower while the RBA has just about exhausted its traditional policy options may well be explored more when governor Philp Lowe addresses a business lunch in Adelaide this Thursday on the hot topic of “The Labour Market and Spare Capacity”.

Oil price rises despite falling demand

To say the oil market is delicately poised is an understatement.

That the global Brent Crude benchmark edged up on Friday was not surprising given the escalating tensions and rhetoric between the US and Iran over a series of attacks on tankers and facilities near the Strait of Hormuz.

The cause of the explosions that left two tankers smouldering and stricken in the Gulf of Oman is still a point of furious disagreement between the US and Iran, and talk of Iranian military fast-boats hampering salvage efforts didn’t help sentiment.

However, another gloomy downgrade for demand is acting in the other direction against supply worries inherent in friction in the biggest chokepoint in the seaborne oil trade.

The International Energy Agency cut its forecast for demand this year by another 100,000 barrels a day with crumbling global trade prospects central to the calculations.

A day earlier, oil cartel OPEC also took a knife to its 2019 forecast with an even gloomier view of demand, barely above 1.1 million barrels day.

“The main focus is on oil demand as economic sentiment weakens … the consequences for oil demand are becoming apparent,” the IEA said.

“The worsening trade outlook [is] a common theme across all regions.”

While the IEA is relatively sanguine about the events of last week off the Iranian coast, arguing supply elsewhere is building, it perhaps misses the point.

Oil is only a bargaining chip in the conflict in the Strait of Hormuz.

The real fight is over US trade sanctions crippling Iran, and Iran’s determination to push ahead with its nuclear ambitions and strategic alliances that are hostile to US and its allies.

It is a very vicious and dangerous circle.

If the situation deteriorates, a trade war will seem pretty mild by comparison.

Australia

| Date | Event | Comment/forecast |

|---|---|---|

|

Monday 17/6/2019 |

Suncorp investor day | Company faces a big decision about its future in banking as it searches for a new CEO |

|

Tuesday 18/6/2019 |

RBA minutes | Extra insights into the June meeting where rates were cut |

| RBA speech | Head of financial stability, Jonathan Kearns, speaks to a property conference | |

| Coles investor day | Insights into future strategy now it is a stand-alone business | |

|

Wednesday 19/6/2019 |

Leading index | May: Westpac series looking ahead in the economy, has been on the slide |

|

Thursday 20/6/2019 |

RBA speech | Governor Philip Lowe in Adelaide on the hot topic of “The Labour Market and Spare Capacity” |

| RBA bulletin | Quarterly publication collating RBA research | |

| Navitas takeover approval | Court hearing to approval the $2.3b takeover of the education business by private equity group BGH | |

|

Friday 21/6/2019 |

Overseas

| Date | Event | Comment/forecast |

|---|---|---|

|

Monday 17/6/2019 |

EU: ECB forum | Big three-day ECB talk-fest starts in Portugal |

|

Tuesday 18/6/2019 |

US: Housing starts | May: Been showing softness |

|

Wednesday 19/6/2019 |

US: Fed rate setting meeting | Betting is evenly split on a hold or another cut |

|

Thursday 20/6/2019 |

JP: BoJ rates decision | Rates already negative, another cut unlikely |

| UK: BoE rates decision | Holding at 0.75pc likely | |

| EU: Consumer confidence | Jun: Fairly glum mood in Europe at the moment | |

| US: Business survey | Jun: Philadelphia Fed survey likely to show a decline in conditions | |

|

Friday 21/6/2019 |

EU: Manufacturing survey | Jun: Markit PMI, activity contracting, particularly weak in Germany |

| US: Manufacturing survey | Jun: Markit PMI, very tepid, activity just above contraction zone |

Topics:

business-economics-and-finance,