Sale of gas assets to China not in national interest, Treasurer says

Updated

A multi-billion-dollar Chinese-backed takeover of more than half of Australia’s gas pipeline network looks likely to be blocked by the Morrison Government.

Key points:

- Josh Frydenberg said the proposal would result in a “undue concentration of foreign ownership”

- This comes despite ACCC approving the takeover

- The news comes as Foreign Minister Marise Payne arrives in China for talks with her counterpart

Treasurer Josh Frydenberg said his “preliminary view” was that CK Asset Holdings Limited’s proposed $13 billion purchase of APA Group was against the national interest.

Mr Frydenberg’s decision is awkwardly timed for the Federal Government, given Foreign Minister Marise Payne arrives today in Beijing ahead of a meeting with her Chinese counterpart Wang Yi.

“I have formed this view on the grounds that it would result in an undue concentration of foreign ownership by a single company group in our most significant gas transmission business,” the Treasurer said in a statement.

“I intend to make a final decision under the formal process within two weeks.

“My preliminary view reflects the size and significance of APA Group.

“It is about the extent to which the proposal is consistent with Australia’s national interest.”

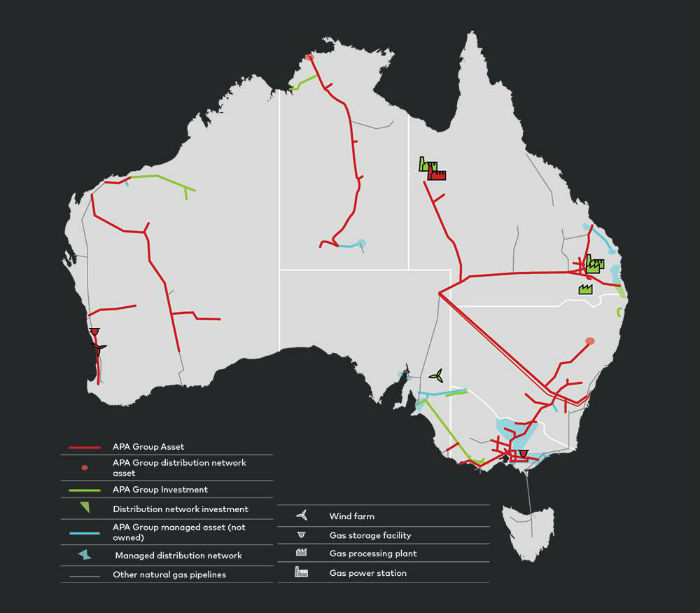

APA Group owns 15,000 kilometres of pipelines, or about 56 per cent of Australia’s gas pipeline transmission system, including 74 per cent of New South Wales and Victorian pipelines.

The takeover had been approved by the Australian Competition and Consumer Commission, but Mr Frydenberg acknowledged the “concentration of foreign ownership” was not a question considered by the watchdog.

Mr Frydenberg said his decision was made in close consultation with the Foreign Investment Review Board, which was split on the proposed sale but expressed concerns about CKI’s asset build-up.

‘Exquisite timing’ for Foreign Minister’s visit

The announcement was made after the close of trade, but on the same day Senator Payne was due to arrive in China.

Her visit is the first by an Australian foreign minister in almost three years and signalled a thawing of relations made frosty by China’s anger at debate in Australia about foreign ownership and claims of foreign interference.

One of Australia’s leading security analysts, Peter Jennings from the Australian Strategic Policy Institute, predicted Senator Payne would face some “surface level” unhappiness in Beijing.

“The timing is exquisite, there’s no doubt about it,” he said.

“But I doubt that this is going to derail Marise Payne’s visit and that’s because no-one would have been more surprised than the Chinese had the sale been allowed to go ahead.”

Mr Jennings had been a vocal critic of the proposed deal and said today’s decision restored his faith in the ability of the Government to make “reasoned” policy decisions.

“I think increasingly what governments are worried about around the world actually is about the vulnerability of critical infrastructure to various forms of cyber hacking,” he said.

“So I’m certain this would have played an important part in Government decision-making.”

Two years ago, some of the companies in the Chinese and Hong Kong-based CK consortium were blocked from buying Ausgrid, the owner of the electricity poles and wires in NSW.

In a statement, a spokesperson said the consortium did not consider Mr Frydenberg’s view of the deal to be reflective of the CK Group itself:

“The CK Group notes the specific reference in today’s announcement that the Treasurer’s preliminary view reflects the size and significance of the APA Group, which is by far the largest gas transmission system owner in Australia; and that the preliminary view is not an adverse reflection on the CK Group.”

Topics:

First posted