Gas producers have cut prices but retailers haven't passed it on, finds ACCC

Updated

Gas prices are set to remain high, despite an easing in fears over a domestic gas shortfall, according to the Australian Competition and Consumer Commission.

Key points:

- The ACCC says falling demand from gas-powered generators and excess production from LNG exporters mean a domestic shortfall in gas is unlikely in the short term

- Despite falling export prices, domestic prices are not falling much and margins remain excessive

- Australian consumers don’t pay more for gas than countries they export to, but our domestic gas is more expensive than rival exporters

The ACCC said a combination of increased east coast production and lower consumption should ease some pressure on the market, particularly for commercial and industrial users in Queensland, but southern states will not get much relief from historically high prices.

In its seventh report on the east coast gas market since 2015, the ACCC found while prices offered by gas producers in Queensland for 2020 supply appear to have fallen, the prices offered by suppliers in the southern states, particularly by the “big three” retailers, have not.

“The drivers behind this are unclear,” the ACCC said.

The so-called netback prices — the cost difference between selling the gas domestically versus converting the gas into LNG and exporting it — have fallen recently from a high of around $11/Gigajoule (GJ) in October last year to $8/GJ by the end of June.

The falling netback prices largely reflect falling demand and spot prices into the Asian market.

“While prices offered by gas producers largely fell below $10/GJ in the first quarter of 2019, prices offered by retailers, mostly to C&I [commercial and industrial] gas users, have remained in the $10-12/GJ range,” the ACCC found.

For the “mass market” residential customers prices are double the C&I market at more than $25/GJ.

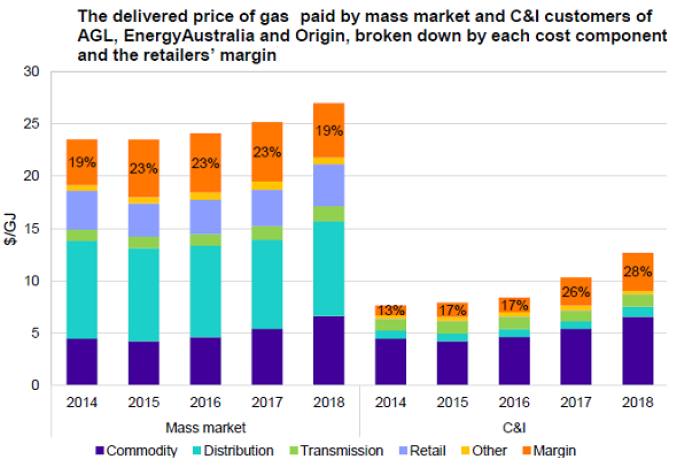

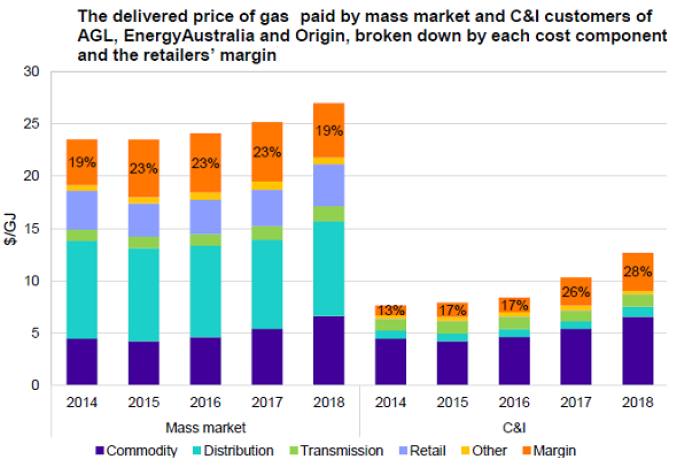

The ACCC found the aggregate margin for the big retailers — Origin, AGL and Energy Australia — in the C&I market last year was 23 per cent and 19 per cent in the residential market.

Photo:

The ACCC says the margins of gas retailers are excessive (Source: ACCC analysis of information provided by AGL, Origin Energy and Energy Australia.)

While margins have narrowed slightly in the retail market since the ACCC started its ongoing surveillance five years ago, they have expanded every year in the C&I market.

“The average gas commodity costs of the three retailers increased at a slower rate than prices did during this period, resulting in significant increases in average margins, particularly in 2017 and 2018,” the ACCC said.

The ACCC’s report found margins from the three big retailers appear to be well in excess of what would be expected from the market.

“If margins were estimated on the basis of a retailer’s cost of acquiring additional gas and selling it under current market conditions, the margin for that specific supply of gas would likely be lower,” it said.

Supply to exceed demand

The ACCC found the east coast market squeeze was likely to be eased by falling demand from gas-powered generators (GPGs) and LNG producers having supplies above their current export contract commitments.

“As a result, their excess gas will likely act as a buffer should domestic demand on the east coast be higher, or gas production lower, than currently forecast,” the ACCC said.

However, the effectiveness of this “buffer” is far from certain, according to the ACCC.

“If the LNG producers offer gas in large quantities that have to be taken over a short time period, there may not be enough domestic buyers who are able to consume, transport and or store this gas within the time constraints.”

Photo:

LNG producers’ 168 Petajoule excess above export contract requirements is likely to provide a supply “buffer” for the East Coast Market (Source: ACCC, AEMO)

Do we pay more than Asian consumers?

The ACCC also took a dive into the vexed question on whether Australians pay more for gas than consumers in countries we export gas to.

The answer would appear to be “we don’t”.

The ACCC contracted global commodities analysis firm Platts to look at prices paid by C&I users around the world and found Australian industry costs are more mid-table than high.

The study found the delivered prices that C&I gas users in the east coast gas market pay are:

- Lower than the delivered prices paid by C&I gas users in Asian countries that purchase Australian LNG such as South Korea and China

- Higher than the delivered prices paid by C&I gas users in other gas exporting countries such as the US and Canada

“This reflects the unique characteristics of the east coast gas market, particularly high gas production costs, high transmission prices and close linkage to the international LNG markets,” the ACCC noted.

Topics:

electricity-energy-and-utilities,

First posted