Four executives paid six-figure salaries to drill into untapped industry

Updated

Photo:

Jemena recently constructed a gas pipeline that links Tennant Creek with Mount Isa. (Supplied: Jemena)

Four Northern Territory public service executives are being paid more than $200,000 a year to facilitate a planned gas industry that some experts doubt will ever stack up economically.

Key points:

- Each NT public service director is being paid between $217,533 and $391,848 per year

- None of the 545 other NT Government executives have “renewable energy”, “solar” or “hydrogen” in their job title

- Questions have been raised as to whether the NT gas industry will stack up financially, as import terminals are approved on the east coast

It has been a year since a ban on fracking in the Northern Territory was lifted, opening up one of the biggest untapped natural gas resources on mainland Australia for commercial development, with engineering works tipped to begin “within days”.

At least four Northern Territory public service executives have now been appointed to manage and implement gas industry regulation, including executive directors of onshore gas reform, onshore gas developments, hydraulic fracturing inquiry implementation and a senior director of petroleum operations.

Each director is being paid between $217,533 and $391,848 per year.

A spokesperson for the Chief Minister said the Government would eventually be reimbursed the costs of these salaries, as government vowed to recover all costs associated with establishing onshore gas regulation.

But while no wells have been drilled following the lifting of the fracking ban, three solar farms are currently under construction — and none of the Government’s other 545 executives have “renewable energy”, “solar” or “hydrogen” in their job title.

Asked if equal resources should also be spent facilitating the renewables sector, the NT Chief Minister’s spokesperson indicated it believed the gas industry offered a more immediate investment opportunity.

“At present, there are multiple gas companies who are on track to begin exploration of onshore gas this dry season,” the spokesperson said.

“We would welcome investment from the hydrogen industry and there is interest both domestically and overseas in the Territory’s hydrogen, though this is in its early stages.

“Territory Labor also has a renewables policy of 50 per cent by 2030 — and hydrogen has a role to play in this.”

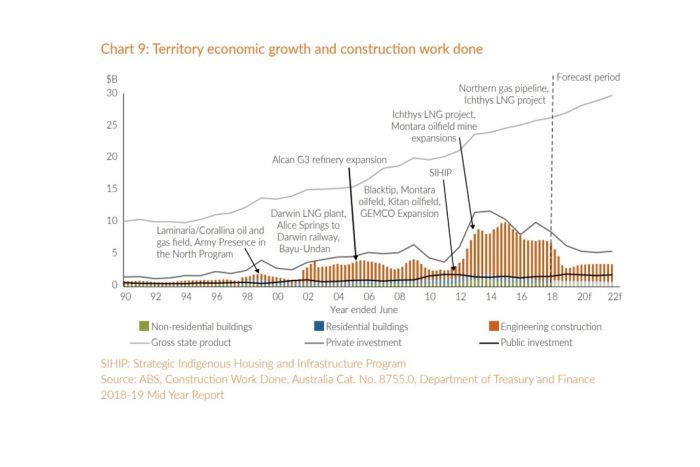

The Territory’s reliance on resource industry projects to fuel its economy during recent decades may give some insight into the enthusiasm of many experts and politicians for a new fracking sector, particularly with Territory debt forecast to exceed $6.2 billion next financial year.

Former NT and Commonwealth public servant Bob Beadman also pointed out the Territory Government’s share of GST receipts — which it relies on for 74 per cent of its revenue — is determined not only by the revenue it collects, but also on the revenue is could collect “if it made an average effort”.

By that logic, continuing a ban on fracking could have been viewed as failing to make every effort to increase revenue, and result in the Territory Government receiving a smaller share of the much-needed money.

That would be a much more difficult accusation to make now.

But some experts, even those who support the Territory’s fracking sector, said there were many questions still to be answered about the industry.

Competition heats up on the east coast

For starters, the key market touted for Territory gas is the same one eyed by proponents of at least five planned import terminals.

According to Matt Doman, from the Australian Petroleum Production and Exploration Association, Territory-sourced gas would most likely go the east coast as it faces a looming shortage.

The Federal Opposition seems to agree and before its recent federal election defeat, pledged to spend $1.5 billion on gas pipelines across the NT and Queensland.

Stewart Johnston, whose company Squadron Energy is the majority shareholder in this Port Kembla import terminal, said it would bring in gas from “wherever is cheapest” globally and could eventually supply the majority of the state’s demand.

However Asian conglomerate Jemena also has plans to expand their 622-kilometre gas pipeline that currently runs from Tennant Creek in the NT to Mount Isa in outback Queensland — which it said could then transport enough gas to fill Sydney, Brisbane and Adelaide’s daily needs.

Jemena is said to be “closely monitoring” the development plans of those companies like Origin Energy and Santos in the Beetaloo Basin.

Asked if a tide of eastern import terminal approvals could have these gas industry giants questioning their interest in the Territory, economist Rolf Gerritsen — who maintained that fracking was the best way to combat the region’s debt crisis — said it was difficult to say.

“I really don’t know,” he said.

“I suspect that fracking will not proceed as rapidly as its initial proponents proposed.”

Origin Energy, which has an exploration project in the Beetaloo Basin, pointed out it still had a long way to go before it would decide if they would proceed to production.

“It’s still early days — and we are in the exploration stage, which will give us more information about the resource and inform a path to market if we progress to production,” it said.

Photo:

Many Territorians want the Government to focus on opportunities in renewable energy and ban fracking. (ABC News: Jane Bardon)

But Graeme Sawyer, from the Protect Country Alliance green group, thought it was interesting new import terminals were being planned when proponents would know full well that a Territory gas industry was in the works.

“It shows up the economics around the whole industry are just so farcical at the moment. And I think a very clear indication that fracking in the NT isn’t going to work,” he said.

“We don’t need this gas — it’s just ridiculous. And the only reason it’s happening is people think they can make some fast money.”

Fuelling Adani’s coal mine

Others have suggested that Territory gas could be used to fuel development in Queensland’s Galilee Basin — particularly after Adani’s controversial Carmichael coal mine was given the green light last week.

Mr Doman said if appropriate pipeline infrastructure was constructed, that was certainly an option and “would be a good thing”.

Another market flagged for Northern Territory gas is overseas, particularly as it already has two major export terminals in the Darwin LNG project and Ichthy’s Inpex LNG project.

But Mr Doman said developing any further export facilities would be a long-term goal.

“Any expansion of existing export facilities in Darwin would require both time and money — we’re talking about billions of dollars of investment and construction process that takes some time,” he said.

In the short-term, he said the focus would be on building knowledge of Territory gas resources before making decisions about possible commercial developments.

Cost of Territory gas questioned

But the eventual cost of Territory-sourced gas was also called into question, particularly as it would have to be piped thousands of kilometres to feed eastern markets.

According to a report commissioned by the South Australian Government, NT gas will be among the most expensive in Australia, with production costs as high as $AU7.50/GJ.

“This estimate will also likely prove to be optimistic,” another report from the Institute of Energy Economics and Financial Analysis stated.

“Even taking the cost of production at face value at $AU7.50/GJ, the costs of production do not compare favourably on a global scale.”

It pointed out that some US gas averaged $AU3.55/GJ in March 2017, while in Qatar gas production costs came in below $AU0.20/GJ.

It is also not clear how much the costs of offsets — activities that must be undertaken to counter the NT industry’s carbon emissions — would impact the end price for consumers.

Mr Doman said while APPEA would prefer to see gas resources developed in eastern states to fill its demand, he believed Territory gas could also be sent east at a competitive price.

Although Squadron Energy’s Mr Johnston said he could potentially see a case for piping Territory gas east in the medium- to long-term — to maintain base load supply — he indicated it could be expensive.

“Whether it would be cheap gas is a different question — because it does have to travel a long way through the pipeline network,” he said.

He added that the Northern Territory is well positioned to take advantage of the growing renewable energy sector, given its wealth of sunshine and proximity to Asia, and said that it should be investing in both renewables and gas.

Topics:

business-economics-and-finance,

nt,

First posted