RBA poised to swing the axe on rates again; the market says it has to

Posted

Photo:

The RBA is likely to swing the interest rate axe again this week, but is it running out of room to cut? (Rae Allen: ABC Local)

Having sat on the sidelines for almost three years, is the Reserve Bank about to get into a cutting binge that would leave Royal Show axemen breathless?

Key points:

- Financial markets have priced in a 70pc chance of the RBA cutting the cash rate to 1pc on Tuesday

- The last time the RBA made back-to-back cuts was in 2012 on fears of a deteriorating global economy

- The $A is likely rise and consumer sentiment fall if the RBA fails to follow through on a cut

The June meeting saw a 25 basis point chip flying off the cash rate, cleaving it down to a new low of 1.25 per cent.

There is little doubt there is more to come.

RBA governor Philip Lowe was about as explicit as a central banker could be when he said it would be “unrealistic to expect that lowering interest rates by quarter of a percentage point will materially shift the path we look to be on”.

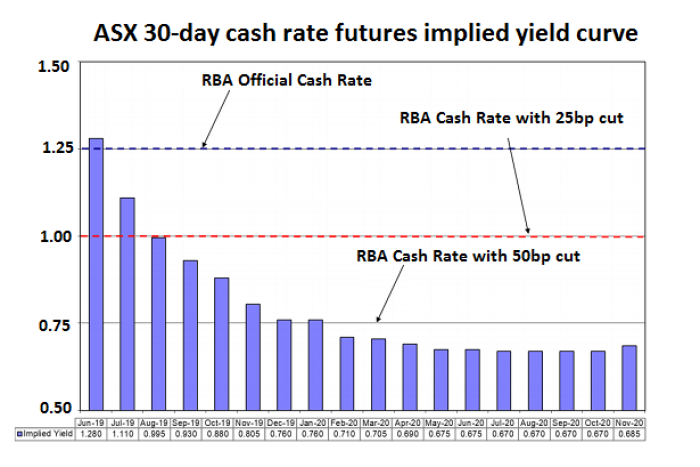

The market has priced in a 70 per cent chance of the axe coming down again at Tuesday’s board meeting, although the odds have been easing of late.

Numerically speaking, market economists roughly match those odds with 28 out of 40 — including those from the big retail banks CBA, Westpac, ANZ and NAB — surveyed forecasting a cut as well.

From there, the market has not fully priced in another cut until early next year and can’t quite bring itself to countenance a fourth cut to 0.5 per cent just yet.

Taken as a collective, market economists see the RBA swinging away lustily for some time yet.

Marginally more than half see two cuts before the end of the year, while three in the survey are predicting the cash rate end up at 0.5 per cent — or a total of four cuts over the cycle.

There is a minority (15 out of 40) who argue Dr Lowe is more a whittler than axeman and will stop to admire his handiwork after the next cut.

Like many of his peers, Westpac’s Bill Evans brought forward his forecast for the cut due to Dr Lowe’s “unusually direct” language.

The RBA’s other key communication has been it wants to see the unemployment rate down closer 4.5 per cent.

“With the unemployment rate at 5.2 per cent, the bank’s forecasts envisaging little improvement over the next two years and the Governor on the record as saying the June move alone is unlikely to shift that path, the case for a July cut already looks to have been made,” Mr Evans said.

But will it work?

Morgan Stanley’s economics team, while being among the snarliest bears on the Australian economy, believes the RBA won’t cut on Tuesday, although noting there is a negligible difference, economically speaking, between a July and August cut.

“We think the RBA communication is less definitive than the market assumes, with the door still open to a pause in July as is our forecast,” Morgan Stanley’s Chris Read said.

“A pause would allow for a more gradual cutting cycle, which has been the RBA’s preference in the past — the last back-to-back rate cut, and also last 50 basis point rate cut — was in 2012 on concerns around the international environment.

“Waiting until August would send a less worrying signal and potentially put more pressure on fiscal policy to act.”

Mr Read is leaning towards the view the RBA may put away the axe after its next cut and rummage around in its monetary shed for an unconventional tool to get the job done.

“Our view remains that at that point they will pause to assess — similar to the most recent cutting cycles — and look to other forms of stimulus, particularly fiscal,” he said.

“However, with the domestic and global economic environment likely to remain soft, we would expect the market to continue to debate eventual further rate cuts, the effective zero lower bound and possible unconventional monetary measures.”

Dollar hinges on a cut

Bank of America Merrill Lynch economist Tony Morriss, is also not totally convinced with the effectiveness of cutting until you have to leap off the log but believes the RBA will be obliged to cut on Tuesday, given heightened expectations in the market.

“Failure to move would shock markets, trigger an unwelcome near-term appreciation of the Australian dollar and weigh on consumer sentiment,” Mr Morriss said.

In other words, pretty well the opposite of what the RBA is hoping to achieve.

Mr Morriss said it is also reasonable to ask if more cutting is prudent if housing is stabilising.

“A stronger question is whether household consumption should be built on another accumulation of household debt that could pose a greater macro risk to the medium-term outlook.”

There is also a question whether the RBA will be able to get inflation back into the target band as low inflation is such a global phenomenon, Mr Morriss says.

A question that no doubt will be addressed further down the track if the cuts fail to deliver the RBA’s desired outcomes; higher inflation, higher wages and lower unemployment.

Market bets on good trade news

Global markets ended the week in a pretty chipper mood, assuming it would be peace-in-our time on the US-China trade front.

Given the complexity of the issue, the stops and starts in negotiations and the wild swings of emotion on the President’s twitter feed, there is a gnawing feeling the traders may be getting a bit ahead of things.

Anyway, the final session for the June quarter was at least full of optimism.

Wall Street was also buoyed by better than expected consumer spending data, coupled with weak inflation figures; the net result being a rate cut from the Fed in July is still a live option.

The S&P500’s solid gain pared back the week’s loss to 0.3 per cent. Locally, the ASX also lost ground over the week, but futures trading points to a solid start to the third quarter.

Markets on Friday’s close:

- ASX SPI 200 futures +0.3pc at 6,577, ASX 200 (Friday’s close) -0.7pc at 6,619

- AUD: 70.2 US cents, 61.7 euro cents, 55.3 British pence, 75.8 Japanese yen, $NZ1.05

- US: Dow Jones +0.3pc at 26,600 S&P500 +0.6pc at 2,942 NASDAQ +0.5pc at 8,006

- Europe: FTSE +0.3pc at 7,426 DAX +1pc at 12,399 EuroStoxx50 +0.9pc at 3,474

- Commodities: Brent oil flat at $US66.55/barrel, Gold flat at $US1,409/ounce, Iron ore $US118.20/tonne

Commodity traders were more circumspect about the outcome of the G20 meeting in general, and the US-China trade talks in particular.

Gold and oil prices were steady, having been on a solid run for a while.

Gold has risen in $US terms almost 10 per cent in the past three months on the back of expectations of the Federal Reserve cutting rates again.

With gold’s safe-haven reputation back in vogue, an acrimonious collapse in trade talks would be a thing of beauty for gold bugs.

On the flip side, such an outcome would probably crush oil prices, amid fears of a slowing global economy and falling demand.

In the near term, OPEC leaders and their oil producing allies, most notably Russia, are meeting in Vienna this week to decide whether to keep a lid on production.

A combination of demand forecasts being revised down and US crude supplies flooding the market means it is a pretty safe bet the supply cuts will be maintained to keep a floor under the oil price.

Housing and retail dominate data releases

Aside from the RBA meeting, there is a fair bit of grist for the macro-mill this week.

Dwelling prices from June are out on Monday. The trend is still likely to be down, but slowing.

Building approvals (Wednesday) and the construction index (Friday) are expected to show conditions in the residential sector continuing to soften, putting jobs at further risk.

Retail sales (Wednesday) should have picked up in May because (a) other more immediate data suggests they will and (b) they wouldn’t want to get worse after April’s nasty fall.

On the brighter side, the trade balance (Thursday) should deliver another surplus of around $5 billion in May.

Australia

| Date | Event | Comment |

|---|---|---|

|

Monday 1/7/2019 |

Dwelling prices | Jun: Probably still falling, but more slowing. Declines of 0.1pc for Sydney & Melbourne forecast |

| Manufacturing surveys | Jun: AiG & CBA surveys likely to report modest expansion in activity | |

| Commodity index | Solid lift expected on back of stronger prices | |

|

Tuesday 2/7/2019 |

RBA rates decision | Another 25bp cut on the cards, although odds are slipping |

| RBA speech | Governor Philip Lowe speaks in Darwin | |

|

Wednesday 3/7/2019 |

Building approvals | May: Always volatile, but the trend has been down |

| Trade balance | May: Ho-hum, $5bn surpluses are becoming mundane | |

|

Thursday 4/7/2019 |

Retail sales | May: April’s fall was weak (even by recent poor standards), but other data point to rebound |

| Job vacancies | May: Employers still looking for (skilled) workers | |

|

Friday 5/7/2019 |

Construction index | Jun: AiG survey. Focus will be on jobs section |

Overseas

| Date | Event | Comment |

|---|---|---|

|

Monday 1/7/2019 |

US: Manufacturing surveys | Jun: PMI fell, possibility activity may have contracted. ISM also weaker |

| EU & UK: Manufacturing surveys | Jun: EU PMI getting more negative while UK PMI fell sharply in May with activity now contracting | |

| JP: Manufacturing survey | Jun: Activity contracted in May, not solid | |

| OPEC meeting | OPEC (and Russian) leaders gather in Vienna to discuss maintaining production cuts and putting a floor under the oil price | |

|

Tuesday 2/7/2019 |

OPEC meeting | A decision expected to be announced on the future of production cuts |

|

Wednesday 3/7/2019 |

US: Trade balance | May: Deficit still stuck at around $US50bn |

|

Thursday 4/7/2019 |

EU: Retail sales | May: Fell previously, not a great sign of things to come |

|

Friday 5/7/2019 |

US: Jobs report | Jun: Job creation likely to rebound after a disappoint May, Unemployment stable at 3.6pc, but wage growth likely to slow again |

Topics:

gold,