Construction slowdown worsens, more jobs are lost and new orders dry up

Posted

The construction sector’s downturn accelerated last month, with a leading industry survey pointing to the sharpest decline in activity in six years.

Key points:

- Construction activity has been contracting for nine consecutive months

- 50,000 jobs were lost last year and another 9,000 in the first three months of 2019

- Falling forward orders across most sectors, but particularly residential building, points to ongoing weakness

The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index (PCI) dropped deeper into contractionary territory in May.

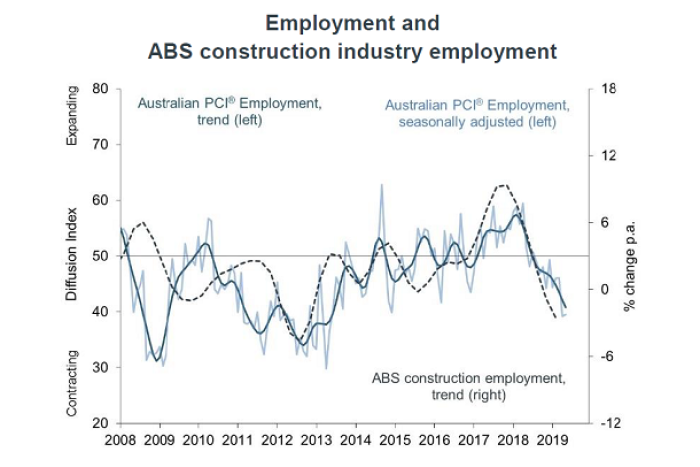

It is the ninth consecutive month of contraction and points to more jobs being lost across the sector.

Last year around 50,000 construction jobs were shed. The figures point to another 9,000 being lost in the first three months of 2019.

“This marked a tenth consecutive month of contraction in employment, consistent with the more subdued readings on activity from mid-2018,” the survey found.

“It indicates that construction businesses are responding to the ongoing weakness of overall demand conditions by exerting greater caution in terms of their labour recruitment.”

Figures from job ad website Seek show that the number of construction positions available fell 16.6 per cent in the March quarter 2019, compared to a year earlier, albeit that was coming off record high levels.

Construction employs around 1.1 million workers and accounts for 9 per cent of total Australian jobs.

Widespread weakness

Tumbling building approvals weighed heavily on residential construction, which is now into its 10th straight month of contraction, with another sharp fall in new orders pointing to ongoing weakness.

Activity in the apartment sector has contracted for 20 of the past 22 months, while the commercial sector — which includes office towers and warehouses — also continues to be a drag on the index.

Engineering work on big civil projects was the only sector to record a positive outcome in May, but only just.

“Disappointingly, the recent soft patch in engineering construction extended into May, although there were encouraging signs of some improvement in tender opportunities and the uptake of new work as more planned infrastructure projects moved through to construction,” Ai Group head of policy, Peter Burn said.

The survey found engineering work was likely to be supported in coming months by solid pipeline of public infrastructure works including transport, wind and solar projects.

“Nevertheless, with construction orders on a broad industry basis dropping at their steepest rate in just over four years, the overall construction downturn looks likely to continue over coming months,” Dr Burn noted.

While new orders and demand are falling, builders still reported they were getting squeezed on higher input costs, driven up by higher energy and commodity prices.

Wages also rose, reflecting enterprise bargaining agreements across the sector rising 6 per cent last year, compared to the broad workforce average of 2.8 per cent and a shortage of skilled labour.

However, this contradicts recent official wages data that showed construction had the lowest annual pay increases of all sectors in the March quarter.

Photo:

Construction activity endured its sharpest fall in 6 years last month (Supplied: AiGroup, HIA)

Topics:

business-economics-and-finance,