Timor-Leste buys stake in Greater Sunrise fields, pushes for LNG pipeline

Updated

For a small country, it’s a plan of vast ambition.

Key points:

- Timor-Leste spending $484m to buy 30 per cent stake in Greater Sunrise

- Australian officials doubt whether Timor-Leste can pull off pipeline plan

- Fledgling nation could face financial disaster if project collapses

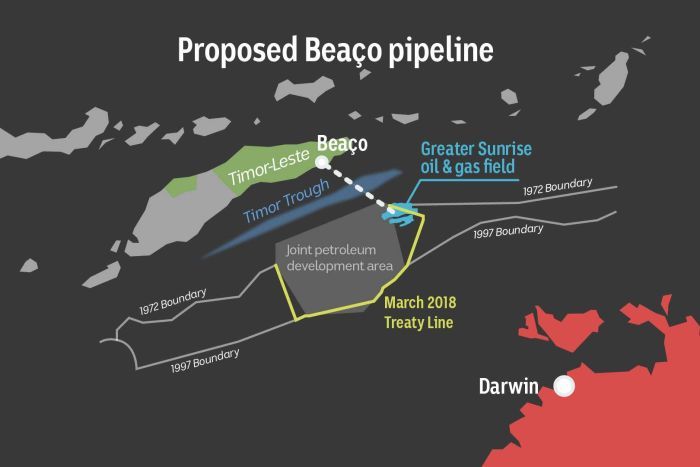

Timor-Leste’s leaders want to build a 150-kilometre pipeline, stretching all the way from the tiny south coast hamlet of Beaço to the vast Greater Sunrise oil and gas fields of the Timor Sea.

That’s not all. They see a new port and a huge LNG plant springing up in the village, processing the 5 trillion cubic feet of gas which lie under the waves.

They see a sleek new highway running along the country’s south coast, linking the LNG plant to a refinery and a sprawling airport, complete with helipads.

And they promise this development will transform not just these towns, but Timor-Leste itself, bringing wealth, skilled jobs and development to the fledgling nation.

Analysts label this vision a pipe-dream, and the multinational companies that hold the rights to Greater Sunrise are unconvinced.

But Dili is pushing ahead. And this week it sent a very big signal that it remained determined, pledging almost half a billion dollars to buy a 30 per cent share in the Greater Sunrise consortium held by US company ConocoPhillips.

Timor-Leste’s former president, Xanana Gusmao, is now set on convincing the other oil and gas giants with a stake in Greater Sunrise that Dili’s vision can work.

It’s a sudden and dramatic manoeuvre. But Timor-Leste knows it has to move quickly.

Right now, almost all of its revenue comes from oil and gas fields that could run dry in less than five years.

And the sovereign wealth fund the nation has built from its natural assets will not last forever. Experts predict it will dwindle to nothing well before 2030.

Why buy out Conoco?

If Timor-Leste wanted any chance of convincing the oil and gas giants to send LNG to Beaço, then it needed ConocoPhillips out of the picture.

Before the most recent move from Dili, exploration and exploitation rights for Greater Sunrise were held by four energy companies — Woodside, ConocoPhillips, Shell and Osaka Gas.

All four venture partners have been deeply sceptical about whether Timor-Leste’s vision of a flourishing domestic LNG industry is viable.

But sources close to recent discussions have told the ABC ConocoPhillips has never looked like budging.

The US energy company simply did not think the project was feasible.

It wanted to send the gas to Australia instead, so it could maintain a reliable supply to its LNG plant across the harbour from Darwin’s CBD.

And its frustrations seemed to grow when Greater Sunrise was ensnared in a bitter diplomatic dispute.

Commercial negotiations were suspended for years while Australia and Timor-Leste wrangled over their maritime boundary — which runs right through the gas fields.

The two nations finally signed a landmark agreement in March this year, with Timor-Leste being granted the lion’s share of royalties.

But by then, ConocoPhillips was already intent on finding new sources of gas for its Darwin plant. It’s been pushing ahead with a new plan to develop the Barossa gas fields 300km to Australia’s north.

Photo:

Timor-Leste now owns ConocoPhillips’ 30 per cent stake in the Greater Sunrise fields. (ABC: Jarrod Fankhauser/Woodside)

Meanwhile, Timor-Leste spotted an opportunity to change the fundamental dynamics of commercial discussions.

Late last week, it offered the Conoco $485 million for its stake in Greater Sunrise.

ConocoPhillips — perhaps wearying of protracted negotiations, and with no compelling reason to stay — took the money, and got out.

One of the company’s vice-presidents, Kayleen Ewin, told the ABC ConocoPhillips and Timor-Leste had “different views” on Greater Sunrise, but insisted it was an amicable parting.

“We had a full and frank exchange of views with Timor-Leste. We respect the fact that their criteria for development is different to ours,” she said.

“For us, we have to make sure that our investments compete in our portfolio. So this was a way to solve the fact that we have different criteria.”

If the other joint partners approve the move, Timor-Leste will get a much more powerful voice at the table, and a substantial new stake in the venture.

But it’s unlikely to be the last time the Government opens the purse strings.

Now Timor-Leste has a stake, it will probably have to funnel billions of dollars from its sovereign wealth fund into the project in order to get it off the ground.

Photo:

Timor-Leste’s leaders want to boost the country’s economy by building an LNG plant and refinery in Beaço. (ABC: Jarrod Fankhauser)

Dr Bec Strating from LaTrobe University said Timor-Leste’s leaders had locked themselves into their pipeline plan by presenting it as a symbol of the small nation’s sovereignty.

“It really draws on nationalistic rhetoric. By describing the pipeline as a non-negotiable it really makes it difficult for them to back away from the vision they’ve established,” she said.

“It’s a rhetorical straight-jacket.”

Dili is also searching for new sources of cash, courting export credit agencies and companies in Asia which might be willing to develop Greater Sunrise and send the gas north.

But close watchers worry its gamble will not pay off — because the project simply does not stack up.

Photo:

Feelings ran high in Dili during negotiations with Australia over control of the oil and gas reserves in the Timor Sea. (AAP/EPA: Antonio Dasiparu)

Just a pipedream?

First, building a pipeline to Timor-Leste poses formidable challenges.

It would have to cross an ocean trench called the Timor Trough, which plunges to depths of more than three kilometres.

One expert predicts it would have to be 75 per cent thicker than the heaviest pipeline ever built before — the Blue Stream, which runs across the Black Sea.

The oil and gas companies are also sceptical about whether Timor-Leste has the capacity to develop an industry from scratch.

Earlier this year, the UN Conciliation Commission published analysis which found Timor-Leste’s proposal would only get off the ground with a government subsidy of about $7.7 billion.

That drew a furious response from Mr Gusmao, who called the assessment “shockingly superficial” and accused Canberra of colluding with the big energy companies to send the gas to Darwin instead of Beaço.

The future is now

The next six months will be crucial, and Australia will be watching the negotiations carefully.

Strictly speaking, the Federal Government is neutral on how the gas fields should be developed — but officials also doubt Timor-Leste’s grand plan can become a reality.

That clearly frustrates Dili, which is using every bit of leverage it can get.

Photo:

Australia and East Timor agreed on a maritime border in March, resolving years of bitter wrangling over the oil and gas riches. (AP: Seth Wenig)

Some Timor-Leste Government figures have been quoted saying if they could not convince the energy companies to get on board, then they might turn to China to help them buy out the other partners and build the new pipeline.

Close observers say that is probably a negotiating tactic rather than a real live option.

But Australia is already wary about China’s growing influence in Pacific Island nations, and the prospect of Timor-Leste taking on a massive soft loan from Beijing would concentrate minds in Canberra.

And there is no need to conjure nightmare scenarios — the current stalemate on Sunrise is already deeply worrying for both countries.

Timor-Leste is a poor country with a burgeoning population and few sources of cash. It desperately needs Greater Sunrise to fill coffers that will rapidly dwindle when the current reserves run dry.

Photo:

Timor-Leste’s leaders hope to secure the country’s future by building the pipeline. (Sarina Locke)

Dr Strating warned if the project collapsed, the small nation could be in dire straits.

“There doesn’t seem to be any other plan for Timor-Leste’s future,” she said.

“So if the pipeline falls through, then what else would there be to try to develop Timor-Leste’s economy in the long term?

“There is a great deal of risk in this strategy.”

If Timor does not find new sources of revenue, it could go over a fiscal cliff within a decade.

That would be a disaster for Timor-Leste.

But it would be a big problem for Australia as well.

Topics:

First posted